Youth Banking Service (Moolr®)

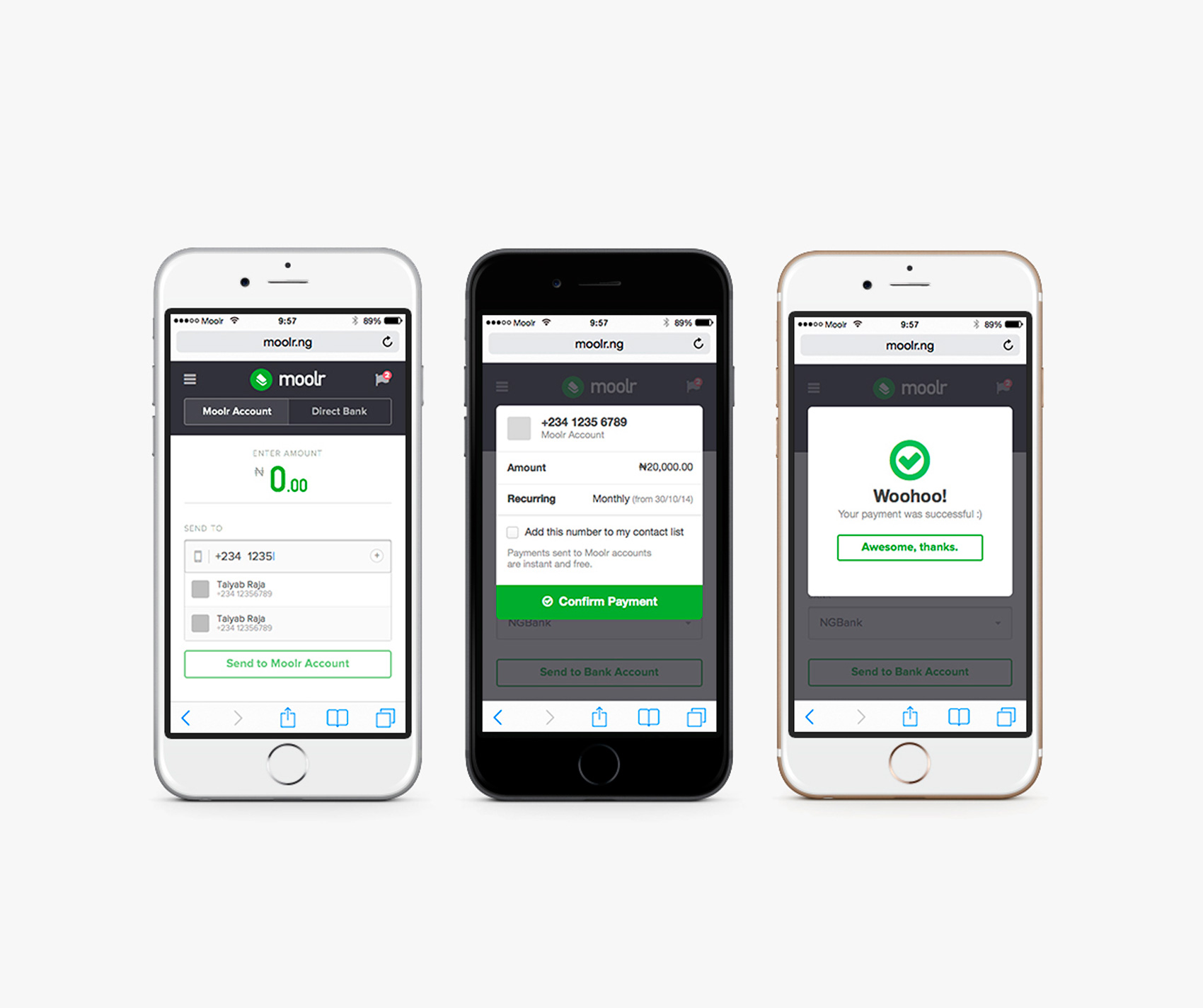

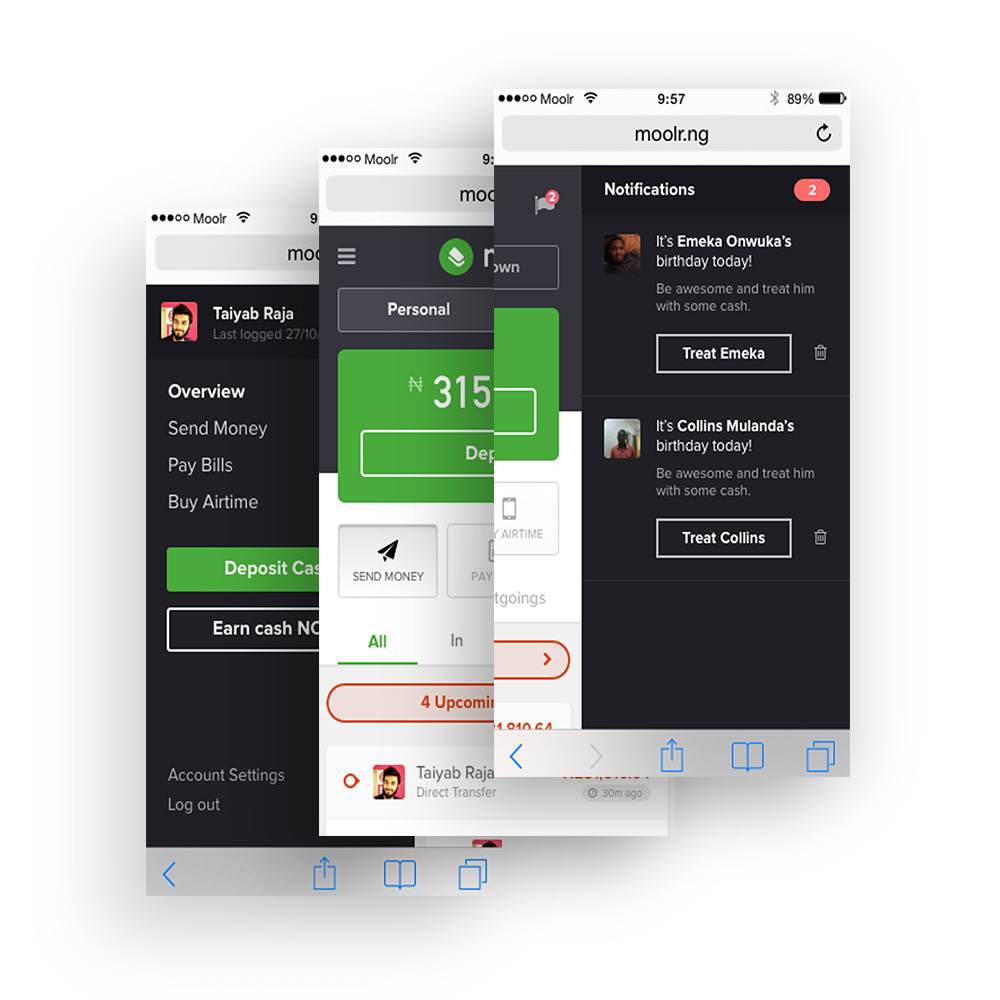

Moolr® is a low cost youth banking platform that leverages social interactivity to create communities as a way of acquiring, growing & retaining young millennials as customers. Moolr® offers transaction simplicity, financial education and transparency to deliver unparalleled mobile digital banking experiences.

The youth are hyper-connected technology-savvy crowds that interact heavily on social media. The youth segment has the highest density of smart phone users. They do not have a lot of money. Financial behavior is primarily transactional. They have dreams that require funding to achieve. They present a natural, largely under-utilized opportunity for banks as they begin their financial life-cycle.

Together in communities, moolr® makes it possible for youth to achieve their financial aspirations, while providing them clear, impactful and relevant financial education and control. The moolr® technology is state-of-the-art and layered on innovative social financial graphs & patterns, presented as a veritable youth banking offering with amazing potential for viral adoption and exponential growth in user base.

Key Features

Enrollment & Instant Card Issuance

Quick seamless enrollment with instant card issuance & dispatch.

Engagement

Transaction timelines, feeds, messaging with bank, merchants & beneficiaries / benefactors.

Analytics and Personalization

Shows what you’re spending on, how, where & why; with tips to enhance savings.

Key Benefits

-

To Youth

- Social – Strong social interactivity with friends on contact lists, around community savings, lending, borrowing & giving.

- Personal – Financial education to support decision making & discipline. Income & Spending analytics. Payments made easy. Post-transaction interactivity.

- Convenience – 100% mobile. Payments made easy & fun.

- Simplicity – Simple, transparent model. No hidden charges.

- Collaboration – Social saving, giving, lending, borrowing & spending.

- Opportunities – Discounts, special offers on e-commerce, services, etc.

Relevant Business Needs

Relevant Business Segment