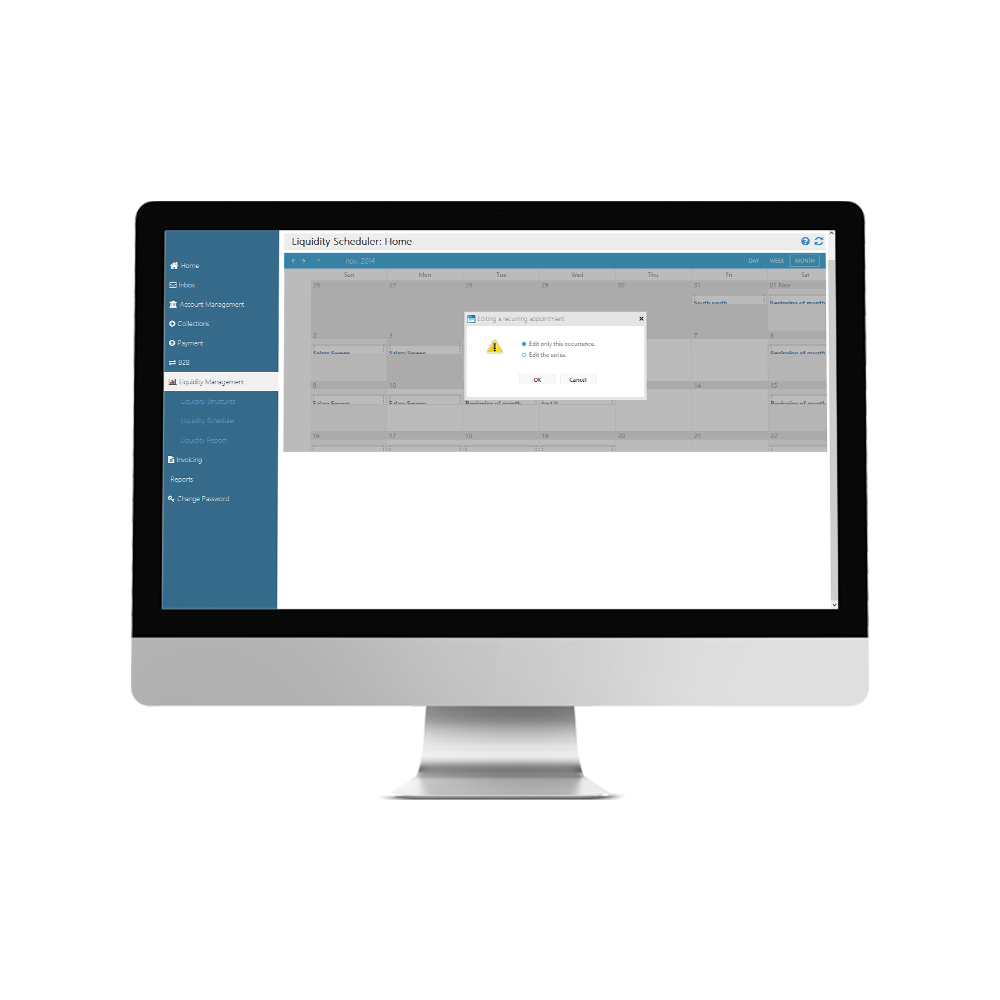

Corporate Liquidity Management System (Infogrid-Bank3D® Liquidity Management)

InfoGrid-Bank3D® Liquidity enables the bank provide its corporate customers with cash concentration/pooling services based on configurable bank account structures (header & sub-accounts), pooling rules (target balances, sweep frequency & direction) and reports.

Many businesses have multiple accounts for different locations or functions and often require transfer of funds to cover for expenses, incoming debits or cheques, and the likes. The use of cash concentration makes it less likely that cash will sit unused in an account that does not earn interest, and also allows for investments in securities that require a minimum investment.

Infogrid-Bank3D® Liquidity is a sophisticated bi-directional cash concentration/pooling services across multiple corporate bank account structures – inter-bank, domestic & international. Through purposeful investments in technology, business domain research & development we have evolved the platform to solve challenges faced by African banks in providing cash management solutions to their corporate customers. The growing sophistication of the corporate and retail banking customers across Africa in a dynamic technological age has placed a great burden of responsibility on the banking and financial services industry to provide veritable value-adding services to customers. Our cutting edge platform, deliver cash management solutions on InfoGrid®-Bank3D core, that are fully integrated and inter-operate on an in-country & regional scale.

Key Features

Inter-Bank Sweeps

Supports for Intra-bank, inter-bank, domestic and international (SWIFT) sweeps.

Integrated Platform

Support for integration to other relevant InfoGrid-Bank3D® offerings such as; Cashflow Planning & Forecasting, and Investment modules on our Cash Management suite.

Settlement Reporting

Robust settlement reporting on liquidity transactions, to aid complex treasury functions.

Key Benefits

- Helps mitigate idle funds thanks to consolidated balances.

- Increased availability of working capital.

- Accelerated cash flows and improved cash forecasting through quicker availability of electronically cleared items.

- Provides powerful, meaningful and relevant financial management information services to bank customers pooled from interplay of cash management services.

- Offers engaging value added services to your esteemed customers.

- Robust technology platform that factors in the peculiarities of the African banking space, and solves challenges faced by African banks in providing cash management solutions to their corporate customers. Already extensively used across 30 African countries.

Relevant Business Needs

Relevant Business Segment