netPAY® is deployed at e-Process to provide the first pan-African online payment gateway for VISA, Mastercard, etc.

Ecobank

Ecobank, whose official name is Ecobank Transnational Inc. (ETI), and is also known as Ecobank Transnational, is a pan-Africanbanking conglomerate, with banking operations in 36 African countries. It is the leading independent regional banking group in West Africa and Central Africa, serving wholesale and retail customers.

Capital Base

As at 2014, Ecobank’s revenue, net income and total assets is $2.28 Billion, $398 Billion and $24.2 Billion respectively.

COUNTRIES OF OPERATION

Angola, Benin, Burkina Faso, Cameroon, Cape Verde, Central African Republic, Chad, Congo Brazzaville, Côte d’Ivoire, Democratic Republic of the Congo, Ethiopi, Equatorial Guinea, Gabon, Gambia, Ghana, Guinea, Guinea-Bissau, Kenya, Liberia, Malawi, Mali, Mozambique, Niger, Nigeria, Rwanda, São Tomé and Príncipe, Senegal, Sierra Leone, South Africa, South Sudan, Tanzania, Togo, Uganda, Zambia, Zimbabwe

YEAR FOUNDED

EMPLOYEES

BRANCH NETWORK

Customers

Zambian Revenue Authority, Malawi Revenue Authority, Du Benin Republique Duty Payments (SEGUB), Togo Duty Payments (SEGUCE), Burkina Faso Electricity (SONABEL), Burkina Faso Water (ONEA), Kyamboyo University, Umeme Electricity, Copperbelt University, etc.

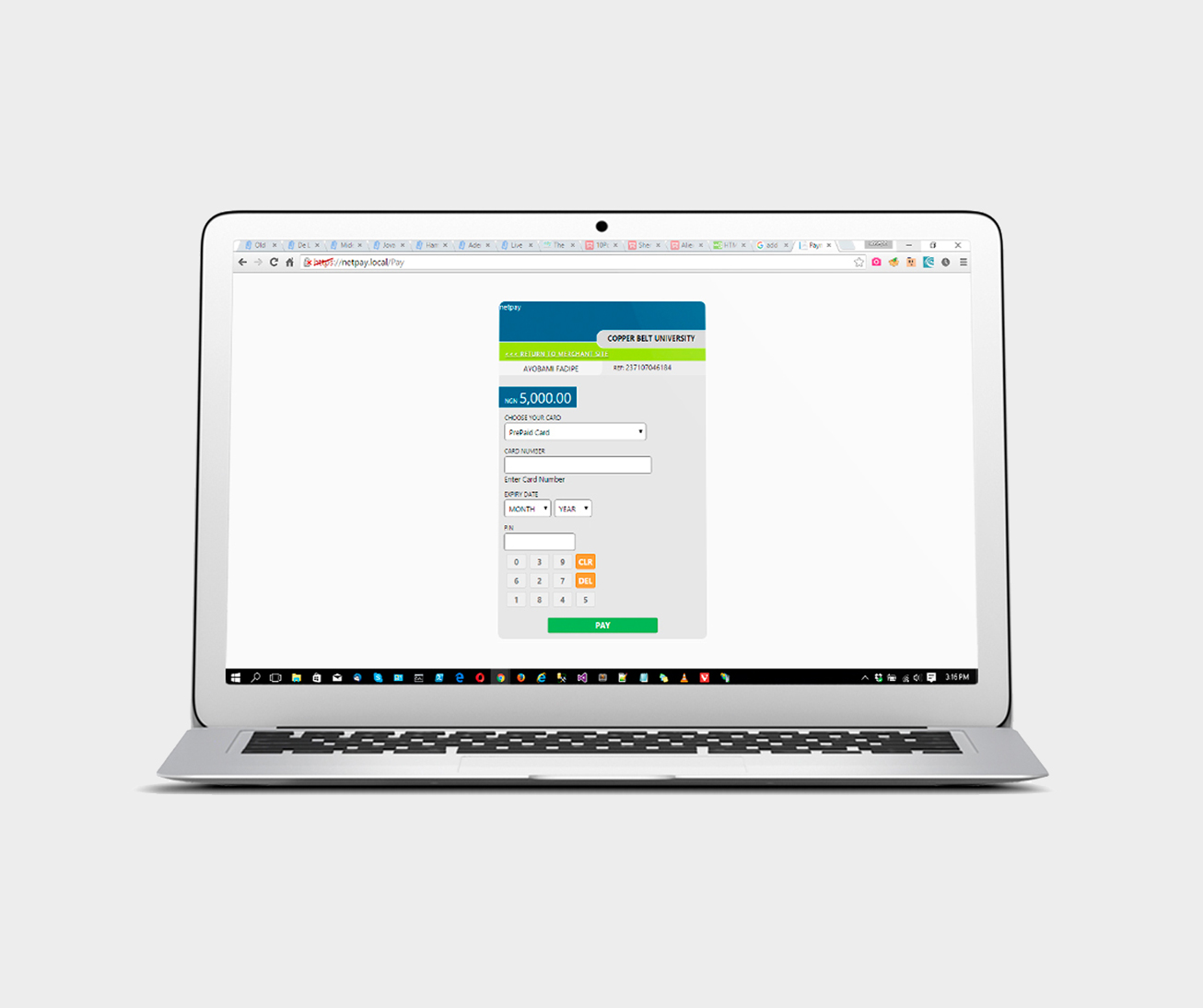

Case Study – InfoGrid-Bank3D netPay®

InfoGrid-Bank3D netPay® is a robust, convenient, & secure web payment gateway that provides support for direct and real-time integration to card/payment processors as well as e-Commerce sites in order to enable the transaction acquirer acquire transactions made online to its corporate customers.

netPAY® is deployed at EcoBank to facilitate the secure transfer of customer payment/card information from the netPAY system to EFT institutions (VISA, MasterCard, etc). netPAY® therefore makes it possible for EcoBank merchants to securely accept payments from their customers via the netPAY system using both EcoBank Group debit cards and other payment cards (VISA, MasterCard). It includes a 3D secure fraud prevention feature