Parkway solutions are designed to leverage, sweat and extend the different channels to

the consumers of financial services whether branch based, assisted or digital.

Branch Automation

Parkway has over the past decade evolved a solid basis for African banks to confidently launch value added corporate and retail electronic banking services across multiple branches, countries, monetary regions, in multiple languages and currencies. Our solutions platform provides full enterprise automation around bank specific main and branch office functions from operations and treasury, to tellering and customer support; we have it all covered for you.

POS/m-POS Integration

We have created smart interactions around point of sale terminals to enable businesses effectively utilize POSs as cash management channels for ordering, payment and reconciliation. With our mobile-POS channel solutions, businesses are now fully empowered to enjoy integrated cash management on-the-go with maximum service availability and customization.

ATM/Kiosk Integration

Banks are empowered to fully leverage their ATM assets through our stateless channels interface; enabling businesses enjoy the added convenience of receiving payments from their customers through ATMs and consolidating such collections onto a single unified cash management platform. We have further developed solutions for payment kiosks to create important options for assisted and self service solution delivery through electronic kiosks.

Mobile/Tablet

All consumer facing solutions from Parkway are responsive web solutions, fully optimized for tablets and smart phones. Designed for intuitive user experiences, heightened consumer engagement and interactivity, our partner banks are now empowered to integrate the solutions into the lifestyles of target consumers building the necessary stickiness required to differentiate and dominate. Some of the solutions also come presented in mobile applications for download and installation on leading smartphones (android, iOS, blackberry, windows).

SMS/IVR/USSD

In targeting the mass market / bottom of the pyramid (BOP) we extensively leverage secure SMS, interactive voice response (IVR) and USSD channels with robust financial transaction grade security & non-repudiation measures built in. The result is a smart blend of solutions consolidated on a single enterprise facing platform through which our partner banks can reach all market segments, aggregate transactions, generate insightful analytics, cross-sell and up-sell to dominate.

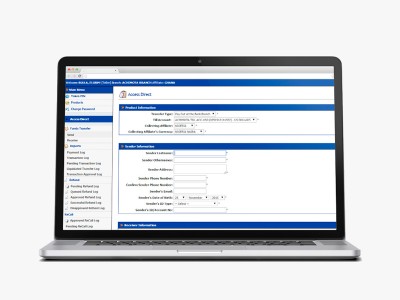

PC/Web

Our solutions are designed to create compelling user experiences on PCs. We lay a premium on simplicity, speed and intuitiveness using state-of-the-arts web technologies layered on robust bank-grade financial application security and control measures, to create modern online banking experiences for bank customers.

Agents

To extend their reach and foot-prints, our partner banks can safely and securely rely on our custom built agent banking solutions integrated into the solutions core, to provide their customers remote banking alternatives for collections, payments and consolidated transactions reporting across a network of bank agents located at the last mile.

Corporate Cashiers

We have included online banking solutions that fully automate the operations of company cashiers for bank business customers. This securely integrates the corporate’s cashier operations to the bank for remote online straight-through processing with the much needed consolidated transactions reporting and reconciliation functionalities.