Access bank employs Parkway’s Infogrid-bank3D corporate cash management suite to provide its business banking customers a world class experience

Access Bank

Access Bank is one of the five largest banks in Nigeria in terms of assets, loans, deposits and branch network; a feat which has been achieved through strong long-term approach to client solutions – providing committed and innovative advice.

Capital Base

Access Bank is a large financial services provider, with an asset base in excess of US$12.6 billion (NGN:2.02 trillion), as of February 2012. The shareholders’ equity in the bank is valued at approximately US$2.33 billion (NGN: 373.5 billion)

COUNTRIES OF OPERATION

Nigeria, Gambia, Sierra Leone, Zambia, Rwanda and Democratic Republic of Congo

YEAR FOUNDED

EMPLOYEES

BRANCH NETWORK

Customers

From the Telecommunication Sector, Oil & Gas Upstream and Downstream, Cement and Logistics, Transportation and Household, Food and Beverages, Financial Institution (Microfinance Banks, etc. ), Value Chain Management, Trading and general commerce, Manufacturing, Hospitality and Lifestyles, Contractor and Construction, Public Sectors and Asian Corporate

Customers being serviced on InfoGrid-Bank3D®: DANGOTE, UNILAG, RRA, ZRA, UNILAG, Covenant University, OAU and many more.

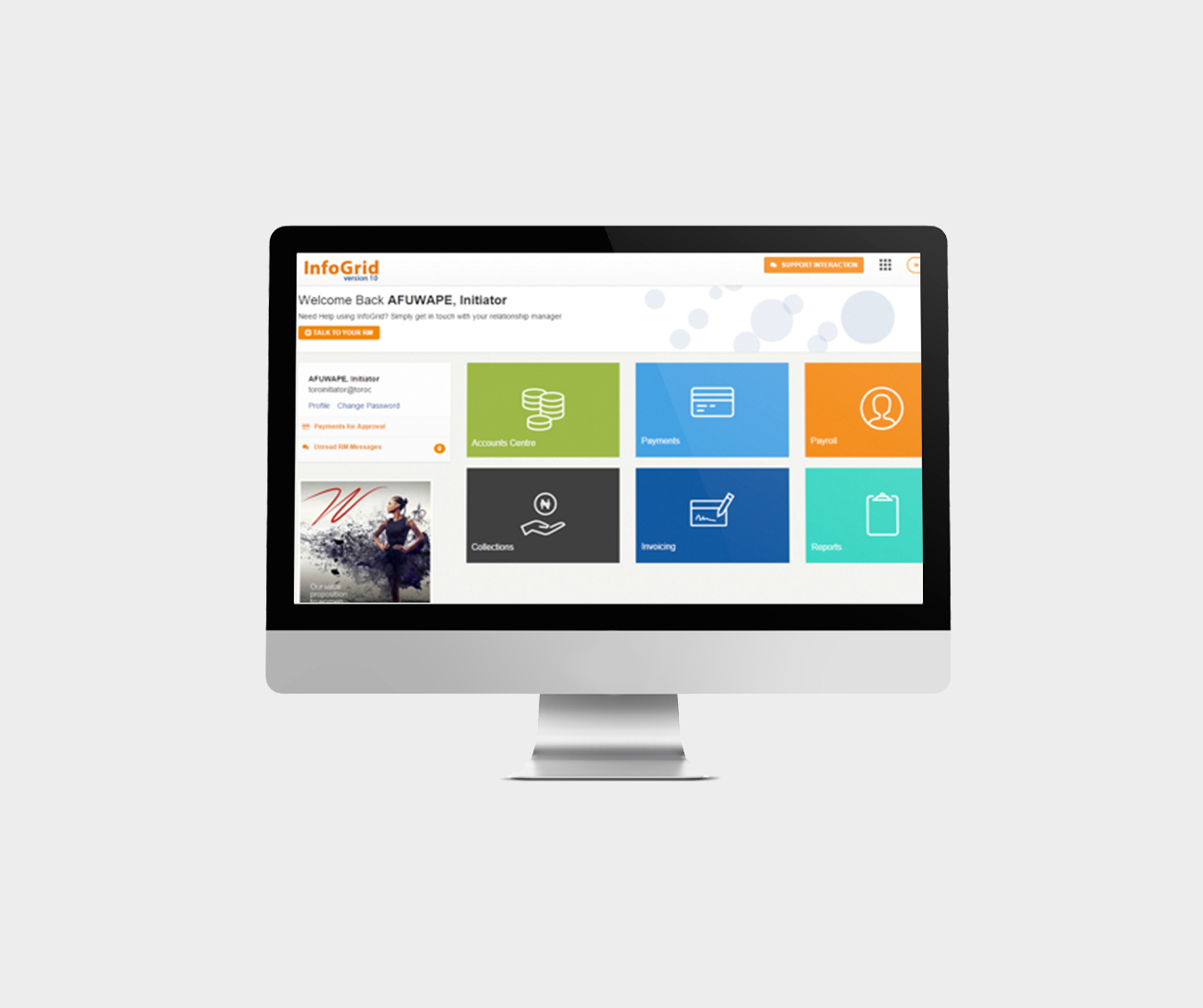

Case Study – Primus-Lite

Primus-Lite is an integrated business banking platform empowering African SMEs, domestic & continental alike, with the tools to cost-effectively and continuously deliver, through a single unified platform, tailor-made services to meet the peculiar remote banking & cash flow needs of SMEs across the continent. Primus-Lite (powered by Parkway’s InfoGrid®-10) is designed to meet the entire cash management needs of Small-Medium enterprises in Africa (from account balances/statements to payments, collections, liquidity interactions/funds transfer, business-to-business payments and electronic invoicing) across multiple bank accounts in a heterogeneous banking environment. It includes such modules as;

- Account Centre/Balances &Transactions

- Customer Management/Relationship Manager Interaction

- Payment Module

- Collection Module

- Auto On-boarding